Article By Wun Kuen Ng

Photo by Jms Lee

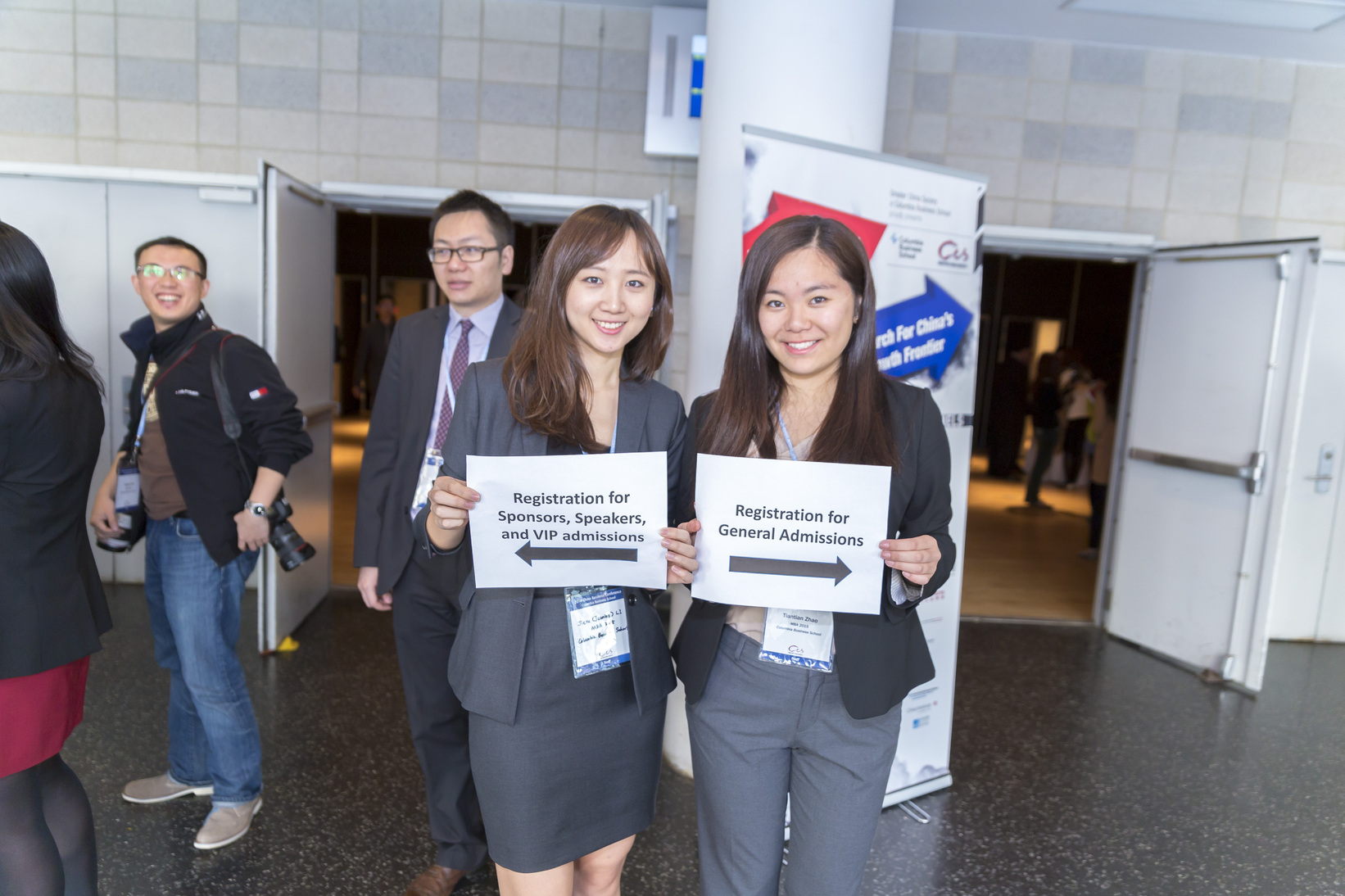

To foster professional and cultural community for students with interest in China, on April 25, the Greater China Society student club of the Columbia Business School hosted its 7th Annual China Business Conference at the Alfred Lerner Hall of Columbia University.

It is an opportunity to get first hand knowledge from the movers and shakers working in the Greater China region. Whether someone is from a multinational company trying to enter the Chinese market, a local Chinese company trying to be a bigger player, part of the Chinese government learning to shift to globalization, or a student gaining a broader network, they can gain insights from the five panels: Macroeconomy, Private Equity & Venture Capital, Seeking Cross-Border Growth, Capital Market & Investment, and Healthcare.

Some highlights from the panel:

Panel 1: Macroeconomy covers topics of urbanization, real estate, manufacturing, RMB, and government’s reliance on investment.

Predictions regarding the urbanization in China include the next ten years the cities will grow out and expand into the suburbs. “You don’t have to move to the city, the city is coming to you,” Jeffrey Townson, Professor of Investment, Guanghua School of Management, Peking University said. People are living 10 meters higher up in the air.

Jian Gao, Ex-vice President, China Development said the future of the RMB in the context of globalization is going to be a long evolutionary process where China will issue RMB bonds in Hong Kong, then RMB swaps in Central Asia and Eastern Europe.

Michael McDonough, Global Head of Economics and Chief Economist, Bloomberg LP made a point that there will be a real estate crisis to get money to invest if the RMB currency opens up.

Panel 2: Private Equity & Venture Capital explores the concept if there are too much capital chasing too few goods.

There are more mergers and acquisitions in China. Foreign investments coming in at the early stages of the companies in China are common, but the exit strategy is a bit harder. Finding the right investment is difficult. The investor has to do due diligence and examine the books. For James Huang, Managing Partner of KPCB, healthcare and ITT are two growth sectors to invest in. To be successful, the company needs to localize the products, management style, and understand the culture.

Panel 3: Seeking Cross-Border Growth examines how the multi-nationals can tap into the foreign market.

The consumer lifestyle in China is changing among the emerging middle class in China, which means ample opportunities for multinational products and services to cater to the new demand. Strategies for joint ventures are easier due to Chinese administration policies in the legal environment and taxation, but having a good relationship still drives businesses.

Panel 4: Capital Market & Investment

The Central Government has deep pockets. The local government does not benefit from the GDP growth. Once upon a time, investors were invited to banquets, but not any more, they go to the cafeteria nowadays.

Panel 5: Healthcare

There is a mixed business model in China. Many local companies consolidate. Now more manufacturers are innovating products. International companies are actively looking for partnerships in China.

One speaker mentioned that there is a trend among the young graduates; to gain knowledge in the United States, then go back to China and really make a difference in China. Given that China has inherent business practices and cultures, China still needs young blood. As for the aspiring business leaders, it is important to culturally fit with a company, treat one’s career as a marathon not a sprint, think more about value, not money, and take time to develop a style, interests outside of work, and a point of view.

The conference has more and more attendees each year. Seven hundred tickets were sold compared to last year’s six hundred. This year an outside marketing firm, Ogilvy & Mather, was hired to do the marketing. Depending on the interest of the incoming class of business school students, guest speakers can come, the panels vary each year.

This year due to difficulties in logistics of getting speakers for a technology panel, there wasn’t one. With the increasing interest in China, the conference can only get more popular and receive better feedback.

Leave a Reply